TRIVEST PARTNERS

STOCADVISORY

Transaction Advisory | Corporate Development | Growth Enablement

Trivest manages a portfolio of founder and family-owned businesses across distribution, consumer, manufacturing, healthcare, and business services. We've completed over 200 transactions and understand the specific challenges of evaluating and integrating companies in fragmented, founder-led markets.

TRANSACTION EXECUTION FOR FOUNDER-LED BUSINESSES

What Makes Founder-Led Deals Different

Founder-led businesses like Big Truck Rental or Pelican Water Systems have unique characteristics. Financial statements may not reflect normalized operations. Customer relationships are often personal rather than contractual. Organizational structure might be informal. Working capital patterns can be inconsistent. Standard diligence templates miss these nuances because they're designed for professionally managed companies.

Post-Close Surprises You Want to Avoid

The founder was running personal expenses through the business, but the adjustments weren't documented properly. Key customer relationships were personal, not institutional. Inventory levels were higher than necessary because of informal ordering practices. Systems and controls need to be built, not just documented. These are the issues that surface 60 days after closing when it's too late to adjust the purchase price.

Experience with Distribution and Consumer Businesses

We've completed diligence on equipment rental businesses, water treatment systems, consumer products, and specialty distribution. We understand the economics of fleet utilization, dealer networks, direct-to-consumer channels, and inventory turns in distribution. We know what normal working capital looks like in these businesses and what red flags actually matter versus what's just different from corporate-owned operations.

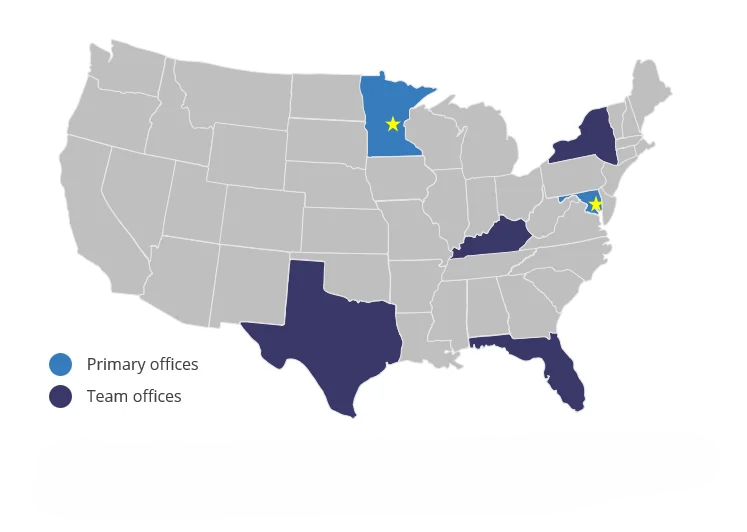

Global team of 30+ professionals with primary offices in Baltimore, MD and Edina, MN.

DILIGENCE THAT PROTECTS THE DEAL

01

Quality of Earnings That Actually Normalizes Founder Operations

Founder-led businesses require different normalization than corporate sellers. Personal expenses, family member compensation, informal customer arrangements, and discretionary spending all need to be identified and properly adjusted. Missing these creates post-close disputes about whether the business is actually performing as expected.

We understand how to normalize founder-led operations. We know to look for related party transactions, informal customer agreements, and working capital inefficiencies that are fixable post-close. We document these adjustments thoroughly so there's no ambiguity about what was included in the purchase price versus what needs to be addressed after closing. This protects both the deal and the founder relationship.

02

Revenue Quality in Distribution and Consumer Businesses

For businesses like Big Truck Rental, revenue quality means understanding utilization rates, contract versus spot pricing, customer concentration in regional markets, and seasonal patterns. For Pelican Water Systems, it means analyzing dealer relationships, direct consumer sales, product mix, and the durability of recurring filter revenue versus one-time system sales.

We assess whether growth is organic or driven by price increases. We evaluate customer concentration in the context of the specific market (three large customers in regional equipment rental may be normal). We identify which revenue streams are defendable and which are at risk. This helps you understand what you're actually buying and what needs to change post-close.

03

Working Capital Analysis That Identifies Hidden Needs

Founder-led businesses often have inefficient working capital. Excess inventory because of informal ordering. Slow collections because personal relationships matter more than payment terms. Vendor relationships that aren't optimized. These create working capital needs that show up after closing when you try to professionalize operations.

We calculate normalized working capital requirements that account for operational improvements you'll make post-close. We identify where the business is over-capitalized (excess inventory, slow AR) and where it's under-capitalized (aging equipment, deferred maintenance). This prevents surprises when you need to inject additional capital 90 days after closing to support the business properly.